5 Factors That Affect Your Credit Score

Credit scores are intended to help financial creditors and others financial institutions make fair decisions on whether or not to “take a risk” on someone. The risk might involve giving that person a loan (will they repay it?), offering a credit card (will they make the payments?) or approving their mortgage application (will they pay their mortgage?).

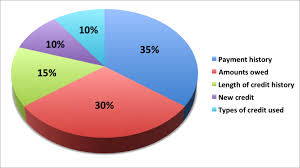

Credit scores are designed to predict the likelihood that individuals will pay their bills as agreed.The five main factors that are taken into account in determining a credit score are:

) Payment history. Do you pay your bills on time? Your credit score may take into account any missed or late payments, how long they went unpaid, and how often.

2) Amounts owed. This includes totals you owe to all creditors, how much you owe on particular types of accounts, and how much available credit you have used.

3) Length of credit history.The age of your oldest credit account, the age of your newest account, and the average age of all your accounts may each play a role in the calculation of your score.

4) New Credit. Have you shopped for or received new credit recently? Applying for credit with different lenders within a short period of time may lower your score, especially if you have a relatively short credit history to begin with.

5) Types of credit. Generally speaking, the more types of accounts you have (credit cards, retail accounts, mortgage loans, installment loans), as well as the total number of accounts you have, influences your credit score.

|

|

|

|